So let’s talk about some of the four most common scams targeting senior citizens today. Now granted, there’s a lot more than these four, but these are the four most common.

Charity Scams

One common scam is to pose as a charity. Impersonating a charity is a serious offense. And, the scammers who do this tend to operate for short periods before moving on to other scams or areas.

Here’s how such a scam typically happens. The scammer picks a trendy cause that’s been in the news recently. The scammer calls and asks the senior citizen to sign up to donate money. Next, the scammer asks senior citizen target to give them a credit card to process “their donation.” So, senior citizen target says “Sure” and gives her credit card number to the scammer. Sally, senior citizen, is so happy. She just saved lives by donating to a worthy cause.

Unfortunately, for Sally, there is no worthy cause. Her loving donation went to a scammer. Now that scammer has her credit card information. Sam, scammer, is now purchasing multiple items as fast as he can. He quickly maxes out Sally’s credit card within minutes. Poor Sally has no idea this is happening.

My Own True Story

True story. I’m in law school at home studying. The phone rings. I answer. “Hello?” Response: “This is Deputy Dugan here from the Toledo Police Department. We are collecting money to buy teddy bears to donate to kids. Would you like to donate? I just need your credit card number.”

Me, silently thinking in my head: “This doesn’t sound right. But, who would impersonate a sheriff? If I don’t give them money, will tehy come and arrest me? Or, will they put me on a list to pull me over when I’m driving through town?” Crazy, I know but hey, I was young.

Luckily, I opted to say “No thank you.” I then hung up on the caller.

I later found out that that was truly a scam that was going on in the area where my law school was located.

This is just an example of how charity scams can be perpetuated against the senior. Sam, scammer, is going to prey on Sally, senior’s, generous nature.

So What Can You Do?

Teach your loved ones to research any charities they wish to donate to carefully, looking up their registration details to confirm that they are real. If they wish to make a charitable donation, have them contact the charity directly to ensure the funds go to the right place.

Let them know that if you receive mail from a charity that you do not recognize that you’ve never heard of, don’t give money to them! Always contact the charity directly if you want to give money to that specific charity. But most importantly, before you do that, research, the charity and you want to make sure the money it’s voluntary, so it should be registered as a nonprofit.

Impersonating Loved Ones

Sam, scammer, is an expert at impersonating loved ones. He researches Grandma Jean and learns she has a grandson, Mikey. He may even discover that Mikey is vacationing out of town. How many people publicly post on Facebook that they are going on vacation?

Here’s how this scam goes:

Ring, ring. Grandma Jean answers the phone. “Hello”

A voice on the other end says “Grandma? It’s me, Mikey. I need you to wire some money to me. I’m being held in jail down here in Panama. I need the money for bail and I can’t reach my parents. I’m so scared, Grandma. Can you help me?”

Now, Grandma Jean is frightened. She vaguely remembers Mikey mentioning going out of town. Was it Panama or Paris? Nevertheless, she must get Mikey money for bail. She can’t have her grandson in jail! So, she either wires the money or gives out her credit card.

But this is not Mikey on the phone. This is a scammer impersonating Mikey. So guess who now has Grandma Jean’s money? Hint, it’s not Mikey. The scammer has Grandma Jean’s money!

Technology Scams

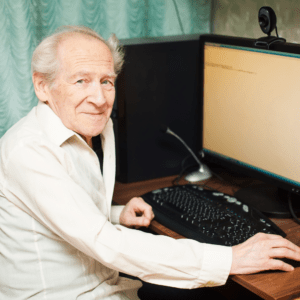

Next we have the technology scams. Unlike this younger generation, senior citizens and even myself, were not born in the computer age. We are not as proficient in trolling through the Internet. We also are not always sure what to click on what not to click on when playing on our computers. Senior citizens especially are vulnerable in this area. And so these scammers will use technology scams to target senior citizens.

Beth’s story

Meet Beth. Beth is a seventy-four year old woman. Beth loves to search her family history on-line through genealogy websites.

One day, Beth sits down at her computer and starts her research. All of a sudden, her computer starts flashing! A loud alarm begins blaring! A message pops up on Beth’s computer screen saying “your computer has a virus.” The message instructs Beth to call a number to have the virus removed.

Beth tries but cannot get the alarm to stop blaring. Her ears hurt. She is terrified. She cannot believe she has a virus on her computer. What will her kids say? After all, everyone knows computer viruses are bad.

Beth’s Dream

So, in a panic, Beth calls the number on the computer screen. A nice man answers the phone. “How can I help you?” Beth replies, “I have a virus on my computer! The message says to call you. Oh and I also can’t get this alarm to stop.”

“No problem, maam, we can help you. I just need your credit card number. I also am going to send you a pop up screen asking for access to your computer. When you see that message, just click accept.”

“Oh, thank you!”, replies Beth. A few minutes later, she clicks the accept button and the alarms miraculous stop blaring. Beth breathes out a sign of relief. She cannot believe this nice man on the phone is fixing her problems. Now her children will never know how their mother got a virus of all things. This nice man is solving her problem and making her life easier.

Unfortunately for Beth, her problems have just begun……

Beth’s Nightmare

The guy on the other end of the phone is not fixing Beth’s computer. You see, there is no virus. Never was. Instead, the virus alert with alarm is part of a technology scam.

Beth unknowingly just gave this stranger on the other end of the phone access to her computer. This person is now downloading all of her account information and passwords. Why? So, that this person gains access to Beth’s personal information.

With Beth’s personal information, the scammer can now drain her bank accounts. He can use her credit card information to max out her credit cards.

Speaking of credit cards, remember the card Beth gave the scammer? Well, right now, that person, or his partner, is maxing out that credit card as well.

Poor Beth has lost all of her money and acquired enormous debt all within a few minutes of time. And, Beth has no idea yet. She is just so happy her computer problem is fixed.

Mike and Microsoft

Meet Mike. Mike is an eighty year old man who also became a victim of a computer / technology scam.

Now Mike loves technology. He constantly emails his grandchildren. He reads the latest news articles on line.

One day, Mike receives a phone call. When he answers, he hears “Hey, I’m from Microsoft Company. We are calling because we have discovered a problem with our software. Because we value you as customer, we are reaching out to help you fix the problem.”

Mike responds, “I had no idea! How nice of you to contact me. What do you need from me?”

“Well, I just need you to allow me access to your computer. It won’t take long for me to fix the problem,” says the person on the phone. So, Mike allows the person access to his computer. Otherwise, the gentleman told Mike, Mike would have to take the computer into a store far away.

Mike is so happy. “How nice of “Microsoft” to alert me about the problem.” “What great customer service!,” Mike thinks.

The Reality

Meanwhile the scammer installs a virus on Mike’s computer. The next time Mike logs on to his computer, he will be locked out from the computer until he pays “ransomware” to get back access to his computer.

And of course, Mike is going to have to using his credit card. The scammers are not going to accept a personal check after all. And, if Mike is lucky, after paying the money, his computer may be unlocked. But, maybe not. Poor Mike.

Don’t be like Mike. Please be aware of any technological scams that may be out there.

Medicaid and Insurance Scams

This is another sad scam. Unfortunately, scammers like to use Medicare and health insurance as a means for their scams.

Let’s face it. Medicare and health insurance plans are confusing! There are big words used. All these different plans to choose with no great explanation of the differences. Oh, and let’s not forget the supplements you can add to these plans.

So, is it any wonder many of us, including senior citizens are confused about what plan they need? I have a law degree and I don’t understand all the medical terminology and jargon.

Now these scammers know that most of us are not savvy about choosing the right health plan. So, they like to call up the elderly.

How It Begins and Ends

The scammers are very sweet and helpful. The scammers acknowledge and empathize with your confusion. So, the scammer says, “Hey, I would love to assist you in choosing the right Medicare plan. In fact, after we have chosen a plan for you, I can get you signed up right now. All I need is a credit card to get started. “

The senior citizen is relieved. “Thank goodness this kind person can help me.” So again, very trusting, he gives his credit card number to the scammer. Naturally, the scammer takes that credit card and runs up a sizable amount of debt.

How to Avoid This Scam

Medicare and health insurance companies are most likely not going to call you directly. If they do call you directly, they are not going to ask you for your credit card or financial information. They’re going to call to schedule an appointment or to tell you about their plans.

If you get one of those phone calls, and you’re not sure if it’s legit or not, ask them for a number to call them back on their line. I guarantee you that nine times out of 10, they’re either not going to give you a number, Or you try to call them back, and that number doesn’t exist.